Working in the government sector offers numerous benefits that make it an attractive career choice for many South Africans. In this section, we will explore some of the advantages of pursuing a government job.

Government jobs provide stability and job security. Unlike many private sector jobs, government positions are less susceptible to fluctuations in the economy. This means that once you secure a government job, you can enjoy the peace of mind that comes with a stable income and job security.

Additionally, government jobs often come with competitive salaries and benefits. While the exact compensation varies depending on the position and level of responsibility, government employees in South Africa generally enjoy fair remuneration packages, which include medical aid, pension funds, and other perks.

Furthermore, government jobs offer opportunities for career growth and advancement. The government sector provides a structured career path with clear promotion criteria. With dedication, hard work, and continuous learning, you can climb the ranks and achieve higher positions within the government.

Types of government jobs available in South Africa

When it comes to government jobs in South Africa, there is a wide variety of sectors and roles to choose from. This section will introduce you to some of the most popular types of government jobs available in the country.

- Education: The Department of Basic Education and the Department of Higher Education and Training offer various job opportunities in the education sector. These roles can range from teaching positions to administrative roles, curriculum development, and educational policy positions.

- Healthcare: The Department of Health is responsible for providing healthcare services to the South African population. Government jobs in healthcare include doctors, nurses, pharmacists, healthcare administrators, and public health professionals.

- Finance: The National Treasury oversees financial matters in South Africa, and government jobs in finance can be found in this department. These roles include economists, financial analysts, auditors, and budget analysts.

- Law and Justice: The Department of Justice and Constitutional Development offers government jobs in the legal field. This includes positions such as prosecutors, judges, attorneys, and legal researchers.

- Infrastructure: The Department of Public Works and Infrastructure is responsible for infrastructure development and maintenance. Government jobs in this sector include civil engineers, architects, project managers, and quantity surveyors.

How to find government job vacancies

Finding government job vacancies may seem like a daunting task, but with the right resources and strategies, you can easily discover opportunities that match your skills and interests. In this section, we will discuss some effective ways to find government job vacancies in South Africa.

- Government job portals: The South African government has dedicated portals where you can search for job vacancies. Websites such as www.gov.za and www.careersportal.co.za provide comprehensive listings of available government positions.

- Newspapers and magazines: Many government departments and agencies advertise job vacancies in local newspapers and magazines. Keep an eye on the classifieds section or the careers section of these publications to stay updated on the latest job openings.

- Networking: Networking plays a crucial role in finding government job vacancies. Attend industry events, conferences, and job fairs to connect with professionals working in the government sector. They might have insider information about upcoming job opportunities.

- Government department websites: Visit the websites of specific government departments that interest you. These websites often have dedicated careers sections where they advertise job vacancies and provide information on how to apply.

- Recruitment agencies: Some recruitment agencies specialize in placing candidates in government positions. Registering with these agencies can increase your chances of finding suitable government job vacancies.

Remember to tailor your job search to the specific sectors and positions you are interested in. It’s also important to regularly check for updates and set up job alerts to stay informed about new vacancies.

Application process for government jobs

Applying for government jobs involves a specific process that differs from the private sector. Understanding the application process is crucial to increase your chances of success. In this section, we will guide you through the typical steps involved in applying for government jobs in South Africa.

- Research and preparation: Start by researching the specific government department or agency you’re interested in. Understand their mission, values, and the requirements for the position you are applying for. This will help you tailor your application to their needs.

- Craft a standout resume: Your resume is your first impression on potential employers. Create a well-structured resume that highlights your relevant skills, experience, and qualifications. Customize it to match the requirements of the job you are applying for.

- Write a compelling cover letter: A cover letter allows you to showcase your motivation and suitability for the role. Tailor your cover letter to address the specific requirements and responsibilities outlined in the job description.

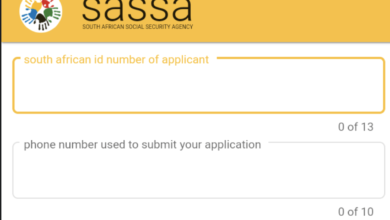

- Complete the application form: Many government job applications require candidates to complete an official application form. Take your time to fill it out accurately and provide all the necessary information.

- Submit supporting documents: Along with your application form, you will usually be required to submit supporting documents such as certified copies of your qualifications, identification, and any other relevant certificates.

- Follow up: After submitting your application, it’s a good idea to follow up with the hiring department or agency to confirm that your application was received. This shows your interest and enthusiasm for the position.

- Prepare for interviews: If your application is shortlisted, you may be invited for an interview. Research common interview questions and practice your responses. Be prepared to demonstrate your knowledge, skills, and experience related to the job.

- Background checks and references: Government jobs often require thorough background checks and reference checks. Ensure that your references are aware and prepared to provide positive feedback about your work ethic and skills.

- Receive an offer: If you successfully navigate the application and interview process, you may receive a job offer. Take the time to carefully consider the offer before accepting or negotiating any terms.

By following these steps and paying attention to the specific requirements of each application, you can increase your chances of securing a government job in South Africa.

Top government departments to work for in South Africa

South Africa offers a diverse range of government departments and agencies, each with its own unique opportunities and challenges. In this section, we will highlight some of the top government departments to work for in the country.

- Department of Basic Education: If you have a passion for education and making a difference in the lives of young people, the Department of Basic Education offers a variety of fulfilling roles. This department is responsible for developing and implementing education policies and programs.

- Department of Health: The Department of Health plays a crucial role in ensuring the well-being of South Africans. Working in this department allows you to contribute to the provision of quality healthcare services and the improvement of public health.

- National Treasury: The National Treasury is responsible for managing South Africa’s finances and ensuring fiscal responsibility. Working in this department offers opportunities to shape economic policies and contribute to the country’s financial stability.

- Department of International Relations and Cooperation: This department is responsible for managing South Africa’s relationships with other countries and international organizations. Working here allows you to engage in diplomacy, international negotiations, and contribute to the country’s foreign policy objectives.

- Department of Public Works and Infrastructure: The Department of Public Works and Infrastructure focuses on infrastructure development and maintenance. Working in this department allows you to contribute to the country’s physical infrastructure, including roads, buildings, and public spaces.

These are just a few examples of the top government departments in South Africa. Each department offers unique opportunities for personal and professional growth, and the right fit for you will depend on your interests, skills, and aspirations.

Skills and qualifications required for government jobs

Government jobs in South Africa often have specific requirements in terms of skills and qualifications. In this section, we will explore some of the key skills and qualifications that are commonly sought after by government employers.

- Education and qualifications: Many government jobs require specific educational qualifications. For example, teaching positions may require a teaching qualification, while healthcare roles often require a relevant degree or diploma. It’s important to carefully review the job description to understand the educational requirements.

- Analytical and problem-solving skills: Government jobs often involve analyzing complex data, identifying trends, and solving problems. Strong analytical and problem-solving skills are highly valued in the government sector.

- Communication skills: Effective communication is vital in the government sector, as employees often need to interact with colleagues, stakeholders, and the public. Strong verbal and written communication skills are essential for conveying information clearly and professionally.

- Leadership and teamwork: Many government roles require individuals who can work well in teams and lead others. Demonstrating leadership potential and the ability to collaborate effectively with colleagues is highly beneficial.

- Attention to detail: Government jobs often involve handling sensitive information and making important decisions. Attention to detail is crucial to ensure accuracy and prevent errors that could have serious consequences.

- Adaptability and flexibility: The government sector is subject to changes in policies, regulations, and priorities. Being adaptable and flexible in navigating these changes is essential for success in government jobs.

- Ethical conduct: Government employees are expected to adhere to high ethical standards and demonstrate integrity in their work. Upholding ethical conduct is essential for building trust and maintaining public confidence in the government.

These are just a few examples of the skills and qualifications that are commonly valued in government jobs. It’s important to carefully review the job requirements for each specific position you are interested in to ensure you meet the necessary criteria.

Challenges and opportunities in the government sector

While working in the government sector offers many advantages, it also comes with its own set of challenges and opportunities. In this section, we will explore some of the key challenges and opportunities that you may encounter in a government job.

- Bureaucracy and red tape: The government sector is often associated with bureaucracy and complex processes. Navigating through the bureaucracy can be challenging and time-consuming, but it also presents opportunities to learn how the system works and develop valuable skills in working within a structured environment.

- Public accountability: Government employees are accountable to the public they serve. This means that decisions and actions must be transparent, fair, and in the best interest of the public. While this can be challenging, it also offers the opportunity to make a positive impact on society and contribute to the greater good.

- Continuous learning and professional development: The government sector offers numerous opportunities for continuous learning and professional development. Government employees have access to training programs, workshops, and conferences that can enhance their skills and knowledge.

- Career stability and growth: Government jobs offer long-term career stability and the potential for growth and advancement. With dedication and a commitment to continuous improvement, you can climb the ranks and take on more challenging roles within the government.

- Impact on society: Working in the government sector allows you to directly impact the lives of South Africans. Whether you’re involved in education, healthcare, infrastructure development, or any other sector, your work can make a difference and contribute to the betterment of society.

While challenges may arise in the government sector, embracing these opportunities can lead to a fulfilling and rewarding career.

Salary and benefits of government jobs in South Africa

Government jobs in South Africa offer competitive salaries and a range of benefits. In this section, we will explore the average salary ranges and some of the benefits that government employees can expect.

- Salary ranges: The salary of government employees varies depending on factors such as the position, level of responsibility, qualifications, and years of experience. However, government jobs generally offer salaries that are competitive with the private sector. Salaries can range from entry-level positions, where the annual income may be around R150,000, to high-level positions that can reach R1,000,000 or more per year.

- Medical aid and pension funds: Government employees in South Africa typically have access to medical aid schemes and pension funds. These benefits provide financial protection and security for employees and their families.

- Leave benefits: Government jobs often come with generous leave benefits, including annual leave, sick leave, and maternity/paternity leave. These benefits allow employees to take time off work while still receiving their salary.

- Job security: As mentioned earlier, government jobs provide a high level of job security. Once you are employed by the government, you can enjoy the stability of a permanent position, reducing the fear of sudden layoffs or job loss.

- Training and development opportunities: The government sector prioritizes the professional development of its employees. This means that government employees have access to training programs, workshops, and courses that can enhance their skills and knowledge.

It’s important to note that the salary and benefits of government jobs can vary depending on the specific department, level of responsibility, and geographical location. It’s always a good idea to research the salary ranges and benefits associated with the specific position you are interested in.

Conclusion: Is a government job right for you?

In conclusion, pursuing a government job in South Africa can offer numerous benefits and opportunities for career growth. From stability and job security to competitive salaries and benefits, government jobs are an attractive option for many South Africans.

However, it’s important to carefully consider whether a government job aligns with your skills, interests, and aspirations. The government sector has its own unique challenges, including bureaucracy and public accountability, which may not suit everyone.

Before embarking on a career in the government sector, take the time to research the specific department or agency you are interested in. Understand the skills and qualifications required, the career prospects, and the potential for making a positive impact on society.

Ultimately, the decision to pursue a government job is a personal one. By weighing the advantages and disadvantages, you can make an informed choice that aligns with your career goals and aspirations. So, if you’re a South African citizen dreaming of a stable and rewarding career in the government sector, take the first step towards a brighter future today!