Are you tired of traditional cable television and looking for a cost-effective streaming alternative? Look no further than DStv Stream. In this article, we will explore the features and benefits of DStv Stream and how it can enhance your entertainment experience.

What is DStv Stream and how does it work?

DStv Stream is a popular streaming service that offers a wide range of channels and on-demand content, allowing you to watch your favorite shows and movies whenever and wherever you want. Unlike traditional cable television, DStv Stream utilizes an internet connection to deliver content to your devices. This means that you can access your favorite shows and movies on your smartphone, tablet, or smart TV, eliminating the need for bulky cable boxes and cords.

DStv Stream works by providing access to a vast library of content, including live TV channels, catch-up TV, and on-demand movies and series. By simply connecting your device to the internet and logging into your DStv Stream account, you can instantly access a world of entertainment at your fingertips.

The streaming service offers a user-friendly interface that makes it easy for anyone to navigate and find their preferred content. With intuitive menus and search functionality, you can quickly discover new shows or movies to watch. Additionally, DStv Stream provides personalized recommendations based on your viewing history, ensuring that you never run out of options.

Features and benefits of DStv Stream

DStv Stream offers a range of features and benefits that set it apart from traditional cable television. Let’s take a closer look at what makes DStv Stream a compelling choice for streaming enthusiasts.

1. Flexibility and convenience

One of the standout features of DStv Stream is the flexibility and convenience it offers. With the ability to stream content on multiple devices, you can enjoy your favorite shows and movies wherever you are. Whether you’re at home, on the go, or traveling, DStv Stream ensures that you never miss a moment of your favorite entertainment.

2. Wide variety of channels and content

Whether you are a sports enthusiast, a movie buff, or a TV series addict, DStv Stream has something for everyone. The streaming service offers a wide range of channels and content, including live sports events, news, series, and movies. With access to popular networks like ESPN, HBO, and BBC, you can stay up to date with the latest shows and events from around the world.

3. On-demand and catch-up TV

One of the key benefits of DStv Stream is the availability of on-demand and catch-up TV. This means that you can watch your favorite shows and movies at any time, even if you missed the original broadcast. With an extensive library of on-demand content, you can binge-watch entire seasons or catch up on missed episodes at your own pace.

4. Parental control options

For parents, DStv Stream offers robust parental control options to ensure that children can enjoy age-appropriate content. With the ability to set up pin codes and restrict access to certain channels or content, you can have peace of mind knowing that your children are only watching what is suitable for them.

5. HD and 4K streaming

DStv Stream supports high-definition (HD) and 4K streaming, providing a crisp and immersive viewing experience. Whether you’re watching a live sports event or enjoying a movie, you can expect stunning visuals and crystal-clear audio quality.

With these features and benefits, DStv Stream offers a compelling alternative to traditional cable television. Say goodbye to cable cords and hello to a seamless streaming experience with DStv Stream.

Comparison between DStv Stream and traditional DStv

While DStv Stream offers a range of advantages over traditional cable television, it’s worth considering how the two compare. Traditional DStv relies on satellite signals to deliver content, whereas DStv Stream utilizes an internet connection. This fundamental difference impacts factors such as installation, cost, and flexibility.

Installation and setup

Traditional DStv requires the installation of a satellite dish and a decoder, which can be time-consuming and may involve additional costs. On the other hand, setting up DStv Stream is relatively straightforward. All you need is a compatible device, an internet connection, and a subscription to DStv Stream. This ease of setup makes DStv Stream an attractive option, particularly for those who want to avoid the hassle of installing satellite equipment.

Cost considerations

When it comes to cost, DStv Stream offers a more budget-friendly option compared to traditional DStv. With traditional DStv, you typically pay for a specific package that includes a predetermined set of channels. If you want access to additional channels or content, you may need to upgrade your package, resulting in higher monthly costs. In contrast, DStv Stream offers subscription options that cater to different budgets and preferences. You can choose from a range of packages that provide access to various channels and content, allowing you to customize your viewing experience while keeping costs in check.

Flexibility and mobility

One of the significant advantages of DStv Stream is its flexibility and mobility. As mentioned earlier, DStv Stream allows you to watch your favorite shows and movies on multiple devices, including smartphones, tablets, and smart TVs. This means that you can enjoy your entertainment wherever you are, whether it’s in the comfort of your home or on the go. Traditional DStv, on the other hand, is limited to the TV connected to the satellite dish and decoder. If you want to watch your favorite shows in different rooms or locations, additional decoders and satellite connections may be required, adding to the overall cost and complexity.

How to set up DStv Stream

Setting up DStv Stream is a simple process that can be completed in a few easy steps. Here’s a step-by-step guide to help you get started:

- Check device compatibility: Ensure that your device is compatible with DStv Stream. The streaming service is available on a wide range of devices, including smartphones, tablets, smart TVs, and streaming media players. Visit the DStv Stream website or app store to check if your device is supported.

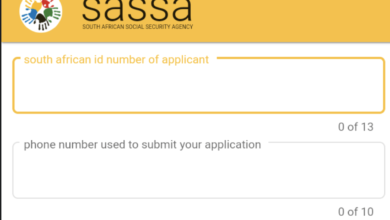

- Create a DStv Stream account: If you don’t already have one, create an account on the DStv Stream website or app. You will need to provide some basic information, including your email address and password.

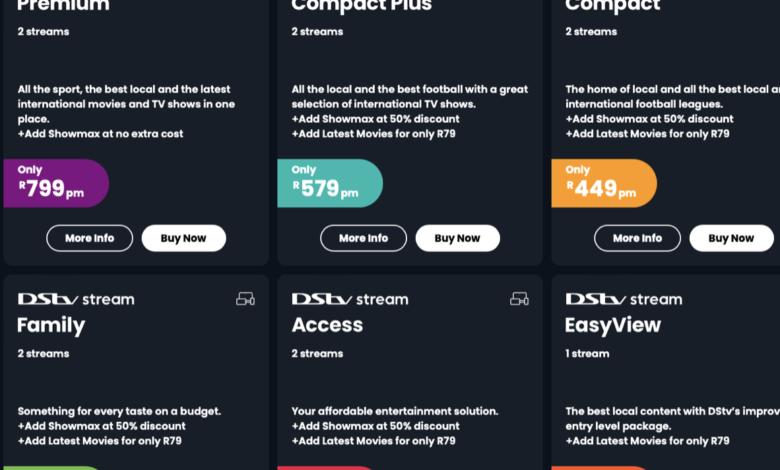

- Choose a subscription package: DStv Stream offers a range of subscription packages to cater to different preferences and budgets. Select the package that best suits your needs and proceed to the payment page.

- Make the payment: Enter your payment details and complete the payment process. DStv Stream accepts various payment methods, including credit cards, debit cards, and mobile wallets.

- Download the DStv Stream app: Once your payment is confirmed, download the DStv Stream app on your device from the app store or the DStv Stream website. Install the app and log in using your DStv Stream account credentials.

- Start streaming: With the DStv Stream app installed and your account logged in, you’re ready to start streaming. Browse through the available channels and content, and select what you want to watch. Enjoy your favorite shows and movies anytime, anywhere.

Setting up DStv Stream is a hassle-free process that ensures you can start enjoying your favorite entertainment in no time.

Available channels and content on DStv Stream

DStv Stream offers a wide range of channels and content to cater to diverse interests. Whether you’re a sports fan, a movie lover, or a TV series enthusiast, you’ll find something to suit your taste. Here are some of the channels and content available on DStv Stream:

1. Live TV channels

DStv Stream provides access to a variety of live TV channels across different genres. From sports and news to lifestyle and entertainment, there’s something for everyone. Popular channels like ESPN, BBC, National Geographic, and Cartoon Network are available for streaming, ensuring that you never miss out on your favorite shows and events.

2. Catch-up TV

With catch-up TV, you can catch up on missed episodes of your favorite shows at your convenience. DStv Stream offers a comprehensive library of catch-up content, allowing you to watch episodes that you may have missed due to other commitments. This feature ensures that you can stay up to date with your favorite series without having to rely on traditional TV schedules.

3. On-demand movies and series

DStv Stream offers a vast collection of on-demand movies and series, giving you access to a library of content that you can watch at any time. From the latest blockbusters to classic films, you can choose from a wide range of movies across various genres. Additionally, popular TV series are available for streaming, allowing you to binge-watch your favorite shows at your own pace.

4. Sports coverage

Sports enthusiasts can rejoice as DStv Stream offers comprehensive sports coverage. With access to channels like ESPN, SuperSport, and Eurosport, you can watch live sports events, including football matches, basketball games, tennis tournaments, and more. Whether you’re a fan of local or international sports, DStv Stream ensures that you never miss a game.

5. Kids’ content

DStv Stream also caters to younger viewers with a range of kids’ channels and content. From educational shows to animated series, there’s plenty of entertainment options to keep children engaged and learning. Parental control options allow you to ensure that your children only access age-appropriate content.

With such a diverse range of channels and content, DStv Stream offers a comprehensive entertainment experience for the whole family.

Pricing and subscription options for DStv Stream

When it comes to pricing and subscription options, DStv Stream offers flexibility to suit different budgets and preferences. Here’s an overview of the pricing and subscription options available:

1. DStv Stream Basic

DStv Stream Basic is the entry-level package that provides access to a selection of live TV channels, catch-up TV, and on-demand content. This package offers a cost-effective option for those who want to enjoy basic entertainment without breaking the bank.

2. DStv Stream Standard

DStv Stream Standard is the mid-tier package that includes a wider range of live TV channels, catch-up TV, and on-demand content. This package offers more channels and content compared to the Basic package, providing a more comprehensive entertainment experience.

3. DStv Stream Premium

DStv Stream Premium is the top-tier package that offers access to the full range of live TV channels, catch-up TV, and on-demand content. With this package, you can enjoy the widest selection of channels and content, ensuring that you never run out of options.

The pricing for each package may vary based on factors such as region and promotional offers. It’s recommended to visit the DStv Stream website or contact customer support for the most up-to-date pricing information.

User reviews and feedback on DStv Stream

To get a better understanding of the user experience with DStv Stream, let’s take a look at some user reviews and feedback:

- “I switched to DStv Stream a few months ago, and I couldn’t be happier. The interface is intuitive, and the content library is extensive. I love being able to watch my favorite shows on my tablet while traveling. Highly recommended!” – Sarah M.

- “DStv Stream has completely transformed my entertainment experience. I used to be tied to my TV, but now I can watch my favorite shows on my smartphone or laptop. The streaming quality is excellent, and the channel lineup is impressive. Definitely worth the subscription!” – John R.

- “I had some initial issues with buffering and playback on DStv Stream, but the customer support team was extremely helpful in resolving the problem. Since then, I’ve been enjoying a seamless streaming experience. The content selection is great, and the user interface is clean and easy to navigate.” – Lisa T.

These reviews highlight the positive experiences that users have had with DStv Stream, including its user-friendly interface, diverse content library, and responsive customer support.

Troubleshooting common issues with DStv Stream

While DStv Stream generally offers a smooth streaming experience, it’s not uncommon to encounter occasional issues. Here are some common issues that users may face with DStv Stream and how to troubleshoot them:

1. Buffering and playback issues

Buffering and playback issues can occur due to a slow internet connection or network congestion. To resolve this, ensure that you have a stable and fast internet connection. You can also try reducing the video quality or closing other bandwidth-intensive applications or devices that may be competing for your internet connection.

2. Login and account issues

If you’re having trouble logging into your DStv Stream account, double-check your login credentials to ensure they are correct. If you’ve forgotten your password, you can use the password recovery option to reset it. If you continue to experience issues, contact DStv Stream customer support for assistance.

3. Streaming errors or app crashes

If you encounter streaming errors or app crashes, try closing and reopening the DStv Stream app. If the issue persists, ensure that you have the latest version of the app installed. You can also try clearing the app cache or reinstalling the app if necessary. If none of these solutions work, reach out to DStv Stream customer support for further assistance.

Conclusion: Is DStv Stream worth it?

In conclusion, DStv Stream offers a cost-effective and convenient streaming alternative to traditional cable television. With its wide range of channels and content, user-friendly interface, and flexibility, DStv Stream provides a compelling entertainment experience for users of all interests. Whether you’re a sports enthusiast, a movie lover, or a TV series addict, DStv Stream has something to offer.

The streaming service’s features, such as personalized recommendations, on-demand and catch-up TV, parental control options, and HD and 4K streaming, further enhance the overall user experience. Additionally, DStv Stream’s pricing and subscription options ensure that you can tailor your entertainment package to suit your budget and preferences.

While there may be occasional issues, such as buffering or login problems, overall user reviews and feedback indicate a positive experience with DStv Stream. The availability of responsive customer support further adds to the peace of mind when using the streaming service.