Investing in stocks can be a rewarding way to grow your wealth and achieve financial goals. While it may seem intimidating at first, with the right knowledge and approach, anyone can begin investing in stocks. This article serves as a beginner’s guide to help you navigate the world of stock market investing and make informed decisions.

Educate Yourself

Before you start investing, take the time to educate yourself about the basics of the stock market. Understand key terms such as stocks, shares, dividends, market capitalization, and various investment strategies. Read books, attend seminars or workshops, and explore reputable online resources to gain a solid understanding of how the stock market works.

Set Clear Financial Goals

Define your financial goals before diving into stock investing. Whether you aim to save for retirement, buy a house, or fund your child’s education, setting clear goals will help you determine your investment horizon and risk tolerance. This will guide your investment decisions and ensure you stay focused on achieving your objectives.

Assess Risk Tolerance

Stock market investments come with inherent risks. Understanding your risk tolerance is crucial in constructing a suitable investment portfolio. If you have a higher risk appetite and a longer time horizon, you may be comfortable with more aggressive and volatile investments. On the other hand, if you are risk-averse, you might opt for a more conservative approach.

Diversify Your Portfolio

Diversification is a key principle in investing. By spreading your investments across different sectors, industries, and asset classes, you can mitigate risk and potentially enhance returns. Avoid putting all your eggs in one basket by investing in a variety of stocks to achieve a well-balanced portfolio.

Choose a Brokerage Account

To buy and sell stocks, you’ll need to open a brokerage account. Research different brokerage firms to find one that aligns with your investment needs. Consider factors such as fees, trading platform usability, customer service, research tools, and investment options. Online brokerages often offer lower fees and convenient trading platforms.

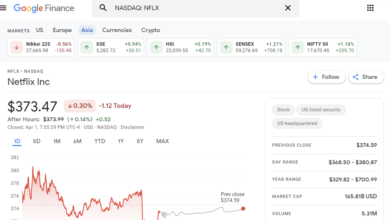

Conduct Fundamental Analysis

Before investing in a stock, conduct thorough research and analysis. Evaluate the company’s financial health, including its revenue, earnings, debt levels, and competitive position. Read annual reports, financial statements, and news articles to gain insights into the company’s prospects and potential risks. Additionally, consider the overall market conditions and economic outlook.

Practice Patience and Long-Term Thinking

Stock market investing is a long-term game. Avoid getting caught up in short-term market fluctuations and focus on the bigger picture. Successful investors often adhere to a buy-and-hold strategy, staying invested for years to allow their investments to grow. Be patient, avoid emotional decision-making, and let your investments compound over time.

Monitor and Review

Regularly monitor your investment portfolio and stay updated on the companies you’ve invested in. Keep track of financial news, earnings reports, and industry trends. While it’s important to stay informed, avoid making impulsive decisions based on short-term market movements. Instead, review your investment strategy periodically and make adjustments as needed.

Consider Professional Advice

If you feel overwhelmed or lack the time and expertise to manage your investments, consider seeking professional advice. Financial advisors can provide personalized guidance based on your financial goals, risk tolerance, and investment preferences. They can help you create a customized investment plan and navigate complex market conditions.

The bottom line on investing in stocks

Investing in stocks can be a rewarding way to build wealth, but it requires careful consideration and informed decision-making. By educating yourself, setting clear goals, diversifying your portfolio, and maintaining a long-term perspective, you can embark on a successful stock market investment journey. Remember, patience, discipline, and continuous learning are key to achieving your financial